Your Step by Step Guide to Financing an ADU Home

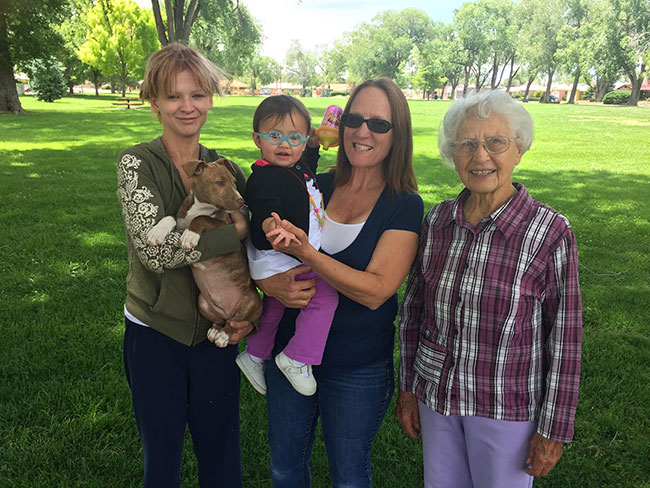

A family has settled into their single-family home and have begun thinking of ways to invest. They consider building an ADU home in the backyard because they’ve heard that it’s a good investment. Or, maybe they’ve found their forever home and want to include a space for their aging parents or in-laws.

There are several reasons why they might consider building one. No matter what the reason is, they know that it’s worth taking on the project. But, as everyone is aware of, building a new structure on your property means going through financing options.

If you’re this family, then it’s time to know your options. Do you know all of the different ways to finance your ADU home? Knowing your options ensures a smooth process.

What is an ADU Home and Benefits of Building One?

An ADU is an accessory dwelling unit that’s built on a single-family zoned lot. ADU homes are commonly referred to as “granny pods,” “in-law suite,” or “backyard houses.” This type of home has its own separate entrance and includes its own living space with a bathroom and a kitchen.

They might be built separate from the main house in the backyard, attached to the house, built into the attic space or basement space. The choice is ultimately yours as long as you follow your local codes and the project makes sense for your individual property. This makes a great space for visiting family, permanently staying family, or renters.

Because ADU homes give you the option to rent out the space year-round, they work well as another means of income and a great investment. And living in San Jose means even more great benefits of building an ADU home. As of 2019, San Jose Mayor Sam Liccardo is pushing for rewarding homeowners who build ADU homes on their property and then rent them out to low-income families.

With all the benefits that come along with it, building an ADU home is something worth considering.

Five Ways to Finance an ADU Home

The best way a homeowner can begin to plan out their financing options is to first determine their financial situation. A homeowners’ best route is to establish how much they qualify for and then decide what’s a realistic amount for them. We at Acton ADU have several financing partners and options that are available, which makes for an easier process. That said, here are some top level options.

Cash-Out Refinance

This type of financing is another mortgage on the home, which pays off the existing mortgage and then leaves extra cash out. This type of loan usually comes with a fixed rate and a 30-year amortization. Closing costs for this type of loan are covered in the new loan amount meaning nothing is paid upfront.

Also, the interest payment and principal remain constant throughout the loan’s lifetime. This type of loan normally goes to about 80% of the home’s appraised value.

Home Equity Line of Credit (HELOC)

A HELOC loan is a second mortgage on the home, which allows homeowners to access the equity in their home. This type of loan has adjustable rates and normally a 30-year amortization with a 10-year interest-only period. This means that homeowners have the option to pay only the interest on the loan and not the principal.

However, after the 10 years, the loan becomes fully amortizing. Homeowners then need to make a payment that’s large enough to cover all the remaining interest and principal for the remaining 20 years. This makes HELOC loans ideal for smaller loans.

This type of loan normally goes to about 80% to 100% of the home’s appraised value.

Personal Line of Credit

Homeowners who have good credit and a good source of income could consider a personal line of credit. They’re normally free to set up with a bank and usually range anywhere between $10,000 to $50,000 (an option to pay for home upgrades, etc.). Although, the rates for these loans are typically higher than HELOCs and mortgages.

Cash or Other

Another option for homeowners is to use cash. This cash is either money that’s been saved for renovations or money taken from investment accounts or retirement accounts. However, homeowners should keep in mind that if the money is taken from a 401K or an IRA, there are expected fees.

These fees are due to early withdrawal. Because of this, this is a decision where a homeowner will need to weigh out the pros and cons.

Construction/Renovation Loan

A construction loan or a renovation loan is a loan that’s based on the home’s appraisal after the construction is complete. This is a great option for homeowners who don’t have enough equity in their home. This type of loan sometimes asks for a downpayment as low as only 10%.

And with Acton ADU financing, for the first year of the loan, you’ll only need to pay interest. There are both low-fixed rate and adjustable rate options for this type of loan. And because the loan is based on the after-construction value of the home, it’s ensured that the homeowner has enough money for the project.

Putting the Project in Motion

After homeowners choose a financing option, it’s time to put the ADU home building project in motion. At Acton ADU, we’re an ADU builder with a process designed to reduce risk.The specialists here at Acton ADU are knowledgeable in all rules and regulations that come with building an ADU home on your property, and can also coordinate and answer questions on ADU Financing.

If you’re considering building your own ADU home, then it’s time to see how Acton ADU can help you. Give yourself peace of mind when planning a large investment and renovation by partnering with ADU builder specialists.